From Senator Nancy Jacobs

Special Session Update: Take Action Now

Nov 10, 2007

Greetings,

In the past you have written me regarding various proposals to raise taxes. As you know, Governor O'Malley has called this special session specifically to raise taxes. One of the most egregious bills he has proposed will raise and expand the sales tax. Knowing your interest in this issue, I wanted to provide you with an update as to the status of the various tax hikes as proposed by Governor O'Malley.

The Senate heard third readings today. Third readings are the final reading in the Senate before the bill is sent over to the House of Delegates. The short summary of it is that all four bills passed.

But the devil is in the details. Republicans and Democrats (Brochin, Della, Klausmeir, and Stone) sought to filibuster the bill. Real quickly, a filibuster is a continuing of debate in perpetuity. In other words we keep talking and talking until the sponsor of the bill agrees to drop it or move it to a later point. Filibusters can be halted by a vote of "cloture" which requires a super-majority or 3/5 of the Senate. In Maryland that means 19 votes. We got 18 and only two and half hours to debate what amounts to the largest regressive tax hike in Maryland's history!

Throughout the day we heard a lot of spirited debate against taxing Maryland families. I spoke on behalf of hardworking taxpayers several times and let me share some of the quotes from myself and my colleagues:

* Senator Nancy Jacobs: "This special session will not only be remembered for passing the largest tax hikes in Maryland history, but for passing bills with huge unintended consequences. I ask my colleagues to put a face on the taxpayers we represent rather doing what you are being told to do by the Democrat leadership."

* Senator Andrew P. Harris: In responding to a rejection from the Budget and Tax Committee Chair to answer questions about the bill: "I've never seen a committee unwilling to answer questions on a bill they proudly brought to the floor. . . I've never seen a committee unwilling to give us the numbers on the largest tax increase in Maryland history. . . It is not a debate when one side refuses to answer questions. . . The truth is - they don't really know the cost. Why won't they reveal the total cost to taxpayers."

* Senator David R. Brinkley, Minority Leader: "Advocates testifying in favor of Governor O'Malley's tax package urge that the entire package be passed because it is "progressive." In reality, over 85% of new revenues in the Senate amended O'Malley package are from regressive taxes, which will greatly harm the working poor and middle-class families of the state."

* Senator Allan H. Kittleman, Minority Whip: "Who are the winners and losers as a result of the tax increases? The clear winner is big government and the clear losers are the citizens of Maryland - who were not heard, not respected and not protected by their representatives."

* Senator E.J. Pipkin: Speaking about the proposed expansion of health care bill on the floor after the filibuster on the tax bill: "If the tax bill was on steroids – then the health bill is on Quaaludes."

I also wanted to update you that this morning Comptroller Peter Franchot sent a letter to Speaker Michael Busch indicating that a sales tax on computer services would "cripple" development of Maryland's high-tech industry. He went so far to say that "the computer firms form the nucleus of the state's new economy."

As far as I'm concerned, none of these taxes were good for Marylanders. I think we effectively hung "Not Welcome" signs up at our borders. Where Delaware says "Tax Free," Maryland says, "Our Motto: Tax, Tax, and more Taxes."

You may think that the fight is over, but that's not the case. Starting this afternoon the House of Delegates has taken up the bills that the Senate passed and some nasty ones of their own (10% hotel tax, automobile repairs tax, etc). It is important that you keep the pressure up on your legislators.

It is unlikely that the House of Delegates will pass the same version of the bill as the Senate. If they don't, then it requires the House and Senator to go to a conference committee to iron out the differences between the two versions of each bill. The conference committee consists of three members from the House of Delegates and the Senate to then vote on a compromise. The compromise is then sent to both committees, so there could be more to come. (You can learn more about the bill process here http://dls.state.md.us/SIDE_PGS/legislation/legislation.html).

The House of Delegates will be meeting off and on all weekend and will probably be voting on Saturday and Monday. The Senate comes back into session on Tuesday. The conference committees will begin meeting and we'l have more votes.

If raising taxes is of concern to you, then you should contact delegates right away and let them know how you feel about the state raising taxes. I t is crucial that constituents keep the pressure on their legislators.

* To find out who your legislators are visit http://mdelect.net .

* To contact your legislator click here http://mlis.state.md.us/cgi-win/mail32.exe.

* To listen to the proceedings click here http://mlis.state.md.us/asp/listen.asp.

I know I told you before, but I am so truly blessed to have the support of all of your from our community. We'll keep fighting and I hope you will too!

Sincerely,,

Nancy Jacobs

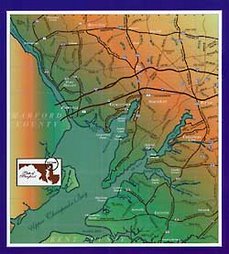

State Senator, District 34 -- Harford and Cecil Counties

Saturday, November 10, 2007

Message from Senator Nancy Jacobs

Posted by

Tim Zane

at

6:40 AM

![]()

Labels: Senator Jacobs, Taxes

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment