November 27, 2007

In the wee hours of the morning and with less than 50 days until the Maryland General Assembly convenes for the 2008 Legislative Session, Governor O’Malley, President Miller and Speaker Busch united to pass on nearly $7 billion in new taxes over the next four years-- $1,222 tax on every man, woman and child in Maryland over the next three years!

Citizens were largely shut out of this hastily thrown together special session and the name of the game was backroom deals. Throughout this process I have stood up for the working families and small business owners of Maryland arguing that they are already over-taxed, over-burdened and evidently under-valued by their government. I tried explaining to my colleagues that now is the worst time to punish Maryland’s families and businesses--the price of gas is sky rocketing, electric rates have gone through the roof and housing market is in turmoil.

These are the taxes that passed:

* Sales Tax increase from 5% to 6% (20% increase)

* New 6% service sales tax on Computer Services (600%)

* MVA title certificate fee increase from $23 to $50, Last summer, Gov.

O’Malley said this increase was too onerous for working families, but

has reversed himself. (120% increase)

* Car Titling Tax increase from 5 to 6% (20% increase)

* Income Tax increases from 5 to 15% for some earners.

* Cigarette Tax increase from $1 to $2 (100% increase)

* Business taxes increase from 7% to 8.25% (Almost 18%)

* No property tax reduction despite Governor O’Malley’s promise

* New transfer tax on real estate transfers of “controlling interests”

* BGE and other power companies that lost exemptions on their property

will certainly pass along these new costs to customers, adding yet

another new tax

* The bills did include recommended spending cuts, but they are not

enforceable and quite frankly very unlikely to ever go into affect.

Gov. O’Malley’s tax plan raises more money than is actually needed to

reduce the “structural deficit.” In fact, Gov. O’Malley’s plan calls for

11%increase to the state budget for next year!

We didn’'t dig ourselves out of the “structural deficit” through new taxation; we just filled one hole and started digging another with these new spending commitments:

* $592 million Global Cost of Education Index

* $580 million Health Care Expansion

* $210 million Chesapeake Bay Fund

* $245 million Higher Education Investment Fund

* $110 million Helicopter Replacement Fund

* $50 million Prince George’s County Hospital Fund

The days of surpluses are over and the credit card governance has returned to Annapolis, in a big way--a $1.7 billion-a-year way.

I wish I could bring you better results and tell you that we squashed their attack on your pocketbooks, but our attempts largely fell short. But you should know that your efforts did not go unnoticed as the House and Senate removed service sales taxes on real estate property management, health clubs, spas, arcades, and lawn care services.

I would also like to report to you that one of my amendments was included in the final package: home schooling parents will not have to pay the computer services sales tax. I do not believe anyone should have to pay this onerous new tax and I voted against the bill as a whole, but I did do my best to protect constituents in any fashion possible.

I invite you to stay in touch and continue to track what’s happening on my website, www.nancyjacobs.com, and I thank you for your support.

Lastly, please consider attending one of our two special events on January 3, 2008 at the Richlin Ballroom in the morning and at Bulle Rock in the evening with Bob Ehrlich. Click here for information.

Sincerely,

Nancy Jacobs

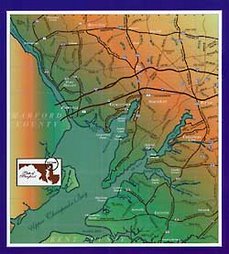

State Senator, District 34 -- Harford and Cecil Counties

Tuesday, November 27, 2007

From Senator Nancy Jacobs - Special Session Update: Final Comments

Posted by

Tim Zane

at

6:34 PM

![]()

Labels: Property Taxes, Senator Jacobs, Taxes

Subscribe to:

Post Comments (Atom)

1 comment:

In a letter to the Cecil Whig, Delegate James boasted that she helped decrease the tax burden to the middle and lower income families by voting to increase the exemption amounts on the Maryland tax returns. I figured that a family of 4 will only save $160 on their tax return with this reduction. This reduction will be quickly wiped out with the increase in sales tax, vehicle transfer tax, tobacco tax and others.

Folks, again while the government was promising to help the lower and middle income families, they were reaching into our back pockets for our wallets. Please remember this in 2010.

Post a Comment